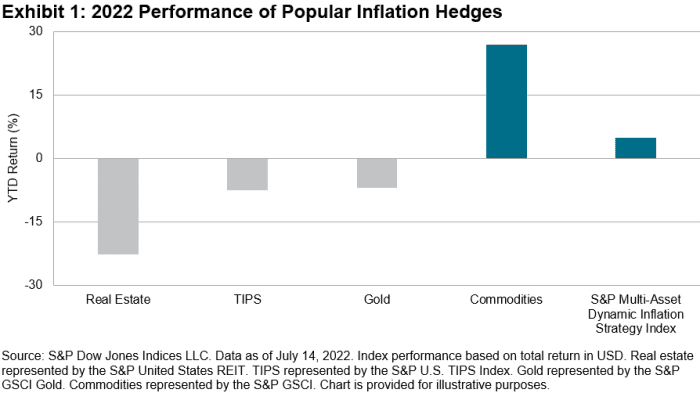

Inflation is very hot in the US and pretty much everywhere too. Meanwhile, the hedges that investors have counted on for protection — real estate, gold, and inflation-protected Treasury securities — aren’t working as well as one might have thought they would.

This chart by Jim Wiederhold, associate director for commodities and real assets at S&P Dow Jones Indices, a division of S&P Global, illustrates the point. In a blog post on Tuesday, he said the year-to-date performance for real estate, gold and TIPS is negative, although commodities “have recently been offering inflation protection in a friendly way.”

Source: S&P Dow Jones Indices. Data shown is as of July 14.

Reasons vary why those hedges have underperformed. In the case of TIPS, which see higher prices and coupon payments when inflation rises, “other factors also matter,” according to Juan de la Hoz of the CEF/ETF Income Laboratory newsletter at Seeking Alpha: Investors have been selling bonds “in anticipation of higher interest, and the TIPs have not been spared,” he wrote in an online post in May.

Regarding gold, Wells Fargo’s head of real asset strategy, John LaForge, blamed the rising US dollar this week.

“So what has been holding the gold back? The U.S. dollar. The US Dollar Spot Index

(DXY) DXY, +0.84% is up a stellar 12.6% this year and is at levels last seen in 2002. This is important because a strong US dollar makes gold look cheap (realized

wrong) to American investors,” he said in a Tuesday note. “For those who value gold in almost any other currency, gold has become quite expensive.”

Behind the outperformance of commodities in 2022 is the huge boost the category is getting from the energy sector, according to Wiederhold of S&P Dow Jones Indices. While gasoline prices RB00, -0.14% made headlines, Wiederhold said that “diesel, heating oil HO00, -0.41% and natural gas NG00, -0.73% were up almost one 100% in 2022.”

Also, while a strong dollar tends to act as a headwind for commodities in general, that’s not the case at the moment: commodities moved first, while the dollar is responding more recently to an abrupt change in monetary policy. target to cool inflation, he said. he wrote in his Tuesday note.

As of Wednesday morning, the S&P GSCI Gold SPGSGC Index, -0.87%, was down about 0.2%. The S&P United States REIT index rose 0.6%, while the S&P US TIPS index showed no performance figures for Wednesday.

Stocks rose on Wednesday, trying to take advantage of a big rebound from the previous session. The S&P 500 SPX, -0.16%, is still down almost 17% year-to-date, while the Dow Jones Industrial Average DJIA, +0.23%, has lost around 12% in the same stretch.

Watch: Energy and materials stocks face a rough ride as commodity prices slide, economist says

Source: www.marketwatch.com