a rare breed

Social Security payments reliably protect against inflation. Critics sometimes question the details of the administration’s cost-of-living adjustments—although, one suspects, few beneficiaries will complain about next year’s 8.7% increase—but in the big picture, such objections are stumbling blocks. beach. Social Security does what the label promises: provide stable, inflation-proof income.

After that… pfft. Traditional investments sometimes thrive during high inflation, as energy stocks did this year, but they offer no guarantees. For their part, almost all annuity payments from insurance companies are nominal and not real. The only investments that consistently repel inflation are Series I Savings Bonds, or I Bonds, but since they can only be purchased in limited quantities and cannot be held in brokerage accounts, they have serious drawbacks.

What about Treasury inflation-protected securities, you may ask? (In fact, it should, since they appear in the title of this article.) After all, his name ensures the deed. Unfortunately, TIPS often falls short of that promise. In the short term, as shown through 2022, TIPS prices may decline while inflation rises. And over the long term, the rates at which TIPS returns can be reinvested cannot be forecast. Consequently, its future cash flows are indefinite.

how the ladder works

However, there is one exception: a TIPS straight. With a little effort, investors can build a TIPS portfolio that actually provides certainty of inflation-adjusted returns. The nominal payouts of the ladder are unknown. But their actual distributions can be specified in advance, with one minor caveat, which I’ll get to shortly.

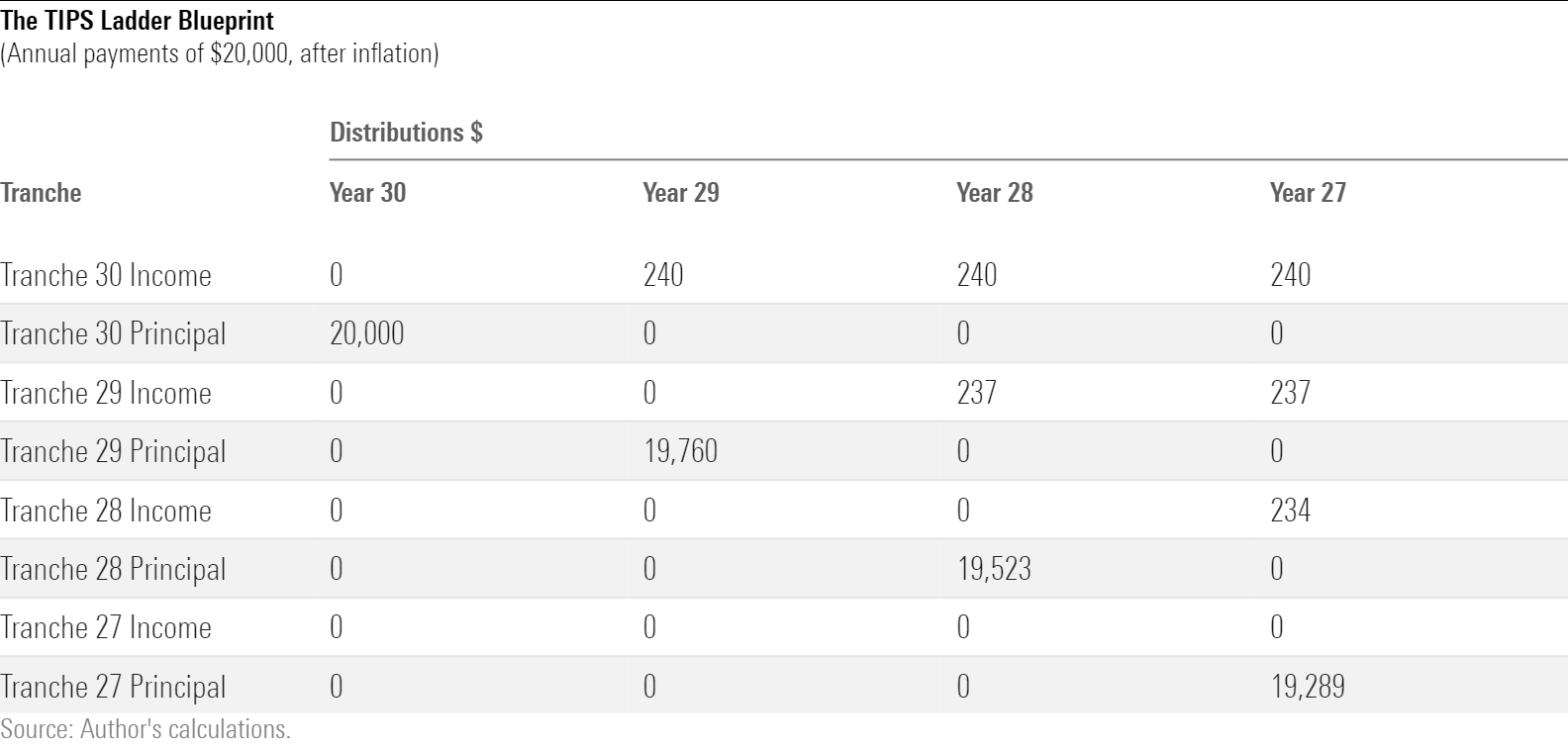

TIPS ladders are built by working backwards. (For this section, I relied on Wade Pfau’s very helpful article, “How Do I Build a TIPS Bond Ladder for Retirement Income?”) dollars Payments begin 12 months from now, which we’ll call the first day of Year 1 They will continue for another 29 years, until the first day of Year 30.

The first step is simple: buy a newly issued 30-year TIPS with a face value of $20,000. Thirty years from now, on the day Year 30 begins, the Treasury Department will redeem that security, thus providing $20,000 of inflation-adjusted proceeds. voila! The 30th year of the TIPS ladder has been addressed.

So far, so simple. The next step, year 29, is not much more difficult. The bond that was purchased for year 30 pays income in year 29, so we must account for its payment. At current prices, that amount will be $240, again expressed in real terms. Therefore, we must purchase $19,760 of TIPS maturing in 29 years.

And so we continue. (Technically, we should buy 60 levels of TIPS, because they pay out semi-annually, but that doesn’t matter. One tranche per year is close enough for hobbyists.) The only complication is the aforementioned caveat, which is that because the Treasury stopped issuing 30-year TIPS for a time during the 2000s, there are no TIPS due between 2033 and 2039. The scale will need to be approximated by holding additional bonds. to go in and out of that period.

For example

The following table shows how the last four years of the ladder are funded. The process is identical for the previous 26 years, although with more and more components.

One critical note: By design, a TIPS ladder depletes the investor’s initial capital. It is not similar to an endowment strategy, which seeks continued income while at least maintaining, if not fully increasing, the investment pool. Rather, it is a cost-cutting strategy that offers the very attractive feature of guaranteed payments, after inflation, but with the drawback of turning into a pumpkin at midnight.

In his recent article “The 4% Rule Just Got a Lot Easier,” planner Allan Roth recounts how he turned theory into practice when implementing strategy. Fortunately, Roth found an online program to organize his scale, telling him which bonds to buy. It took him some time to fill his orders, since the TIPS market doesn’t work as well as, say, the stock market, but two hours later, Roth had his portfolio.

price check

Now that you know how to build a ladder, should you do it? The answer is no for those who make more money than they spend, which is presumably the case for all the working people reading this article. Such investors do not need additional income at all, no matter that it is guaranteed, under all conditions, to offset inflationary increases.

The answer, naturally, is more nuanced for retirees. It starts with the cost. If the TIPS are extremely cheap, the TIPS ladders will have great appeal, even for those who are not very concerned about future prices. If they’re expensive, they’re suitable only for those who are especially wary of inflation, or who for some other reason must have more inflation-guaranteed income than Social Security provides.

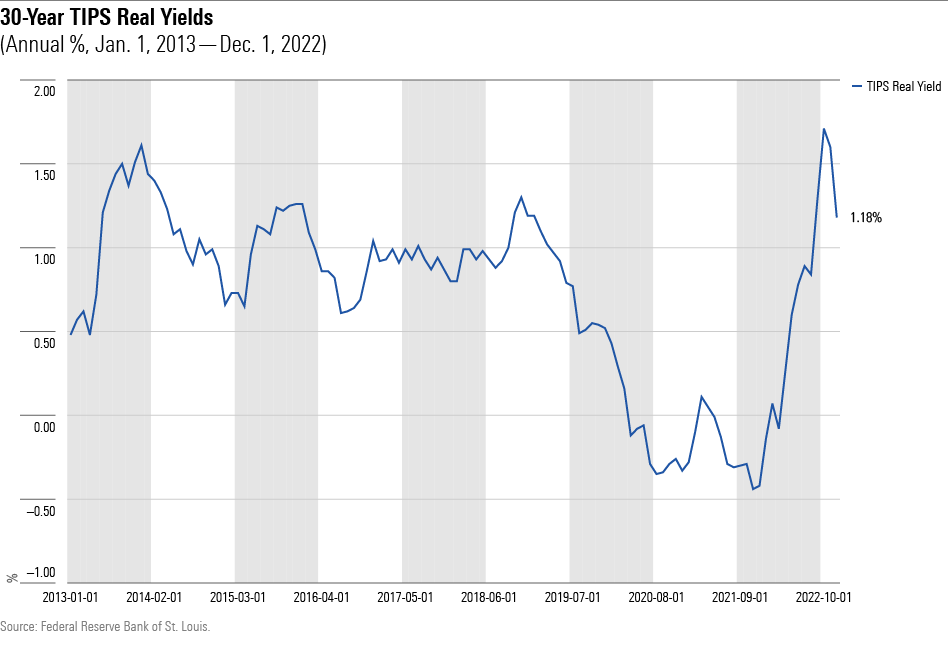

Addressing whether TIPS are currently affordable requires two points of view. One is how long ladder bonds are priced. When Roth executed his strategy just two months ago, real returns on 30-year TIPS were at their highest level since 2011. (Confusingly, the explicit part of a TIPS return is called “real,” while the return on a bonus I is called “fixed. They are the same). Since then, they have lost half a percentage point, falling from 1.7% to 1.2%. That puts them slightly above their 10-year average.

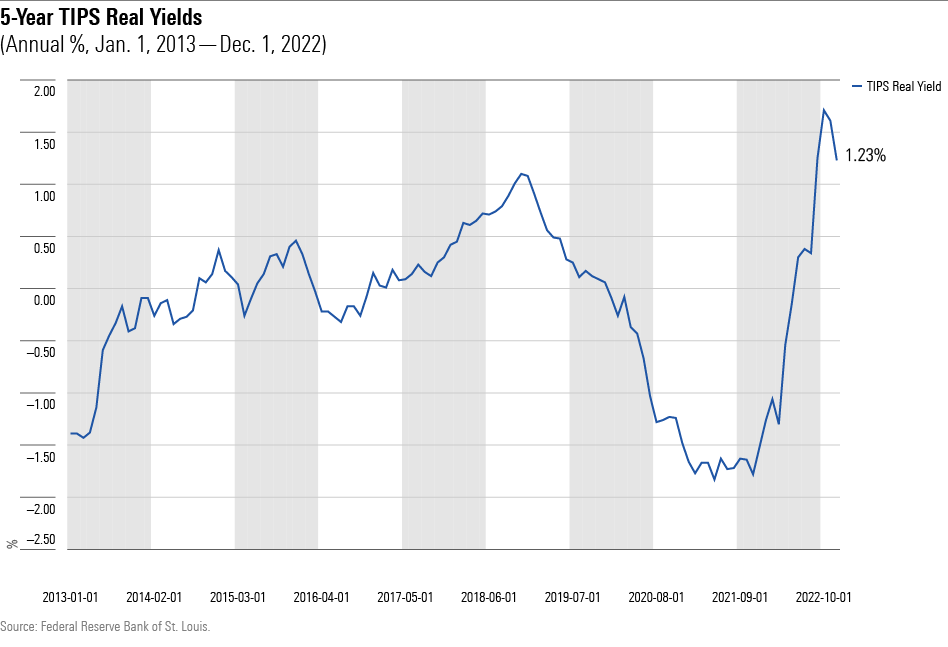

However, long interest rates are only part of the story. A TIPS ladder also contains years that are coming relatively soon. The news there is better. Presumably because the yield curve for conventional bonds has inverted, with short- to medium-term bonds now paying more than long-term bonds, the real yields on five-year TIPS are unusually high. They, too, have fallen since Roth built his portfolio (his shot at him was impeccable), but they’re still well above his usual levels.

Summary

This column has discussed at a high level how TIPS ladders are built. It has also shown that TIPS are attractively priced. Which leads to two more questions. If I build a TIPS ladder, what will my return be? And how does that result compare to what you might receive from other investment approaches? These issues will be addressed in future articles.

John Rekenthaler ([email protected]) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar’s investment research department. John is quick to point out that while Morningstar generally agrees with the views of the Rekenthaler Report, his views are his own.

Source: news.google.com