Finally, proper inflation coverage!

Professional investors immediately took Treasury inflation-protected securities seriously. While TIPS’s familiar counterparts, Series I Savings Bonds (also known as I Bonds, or inflation bonds), attracted just $360 million during their first full year of operation, TIPS received $31 billion when they debuted, in 1997. Last year, the Treasury issued $186 billion worth of TIPS, bringing the outstanding balance of TIPS to almost $2 trillion, 5 times more than bitcoin and twice the size of the entire cryptocurrency market.

In other words, TIPS have become a big deal. And why not? Before TIPS, there were no securities specifically designed to combat inflation. Investors could cobble together accidental inflation hedges, such as gold, energy stocks, or perhaps real estate, assets that might peripherally benefit from higher prices or at least suffer less damage than core stocks, but were not directly related to changes in the price. consumer price. Index. TIPS are. When the IPC rises, the Treasury raises the principal value of all TIPS by that amount.

TIPS have become fixtures in the portfolios created by sophisticated financial advisors, as well as in many leading mutual funds. For example, American Funds Bond Fund of America ABNDX has more than 10% of its assets in TIPS, as do the Vanguard Target Retirement 2020 VTWNX and T. Rowe Price Retirement 2020 TRRBX funds. As the last two funds suggest, investment professionals often use TIPS for retirees. Given enough time, it is thought, stocks will outpace inflation, but retirees cannot afford such patience. They need protection that works fast.

inflation is coming

Until very recently, the TIPS insurance policy was not used. During the 24 years from January 1997 to January 2021, the annualized rate of increase in the CPI was just 2.09%. For all practical purposes, inflation was not an investment hazard. Holding 30-day Treasury bills would have almost matched the rate of inflation, earning 1.99% annualized, and holding something even a little bolder would have outdone it. TIPS were useful in theory but unnecessary in practice.

Then came the resurgence of inflation, in the spring of 2021. Financial markets were initially skeptical that inflation would persist; Despite the rally in the CPI, stocks continued to rally through the rest of 2021, while bonds held firm. In fact, the yield on a conventional 10-year Treasury bond was lower on December 31, 2021 than it was on April 12 of that year, which was the day before the Labor Department announced the first of what would be many inflationary shocks. .

Everything changed with the new year. In January, both stock and bond prices plummeted, suffering a tandem decline that continues to this day. The reason: inflation that far exceeded economists’ expectations, prompting the Federal Reserve to raise interest rates much higher than expected. TIPS would finally have its moment! Your inflation protection would now show its value.

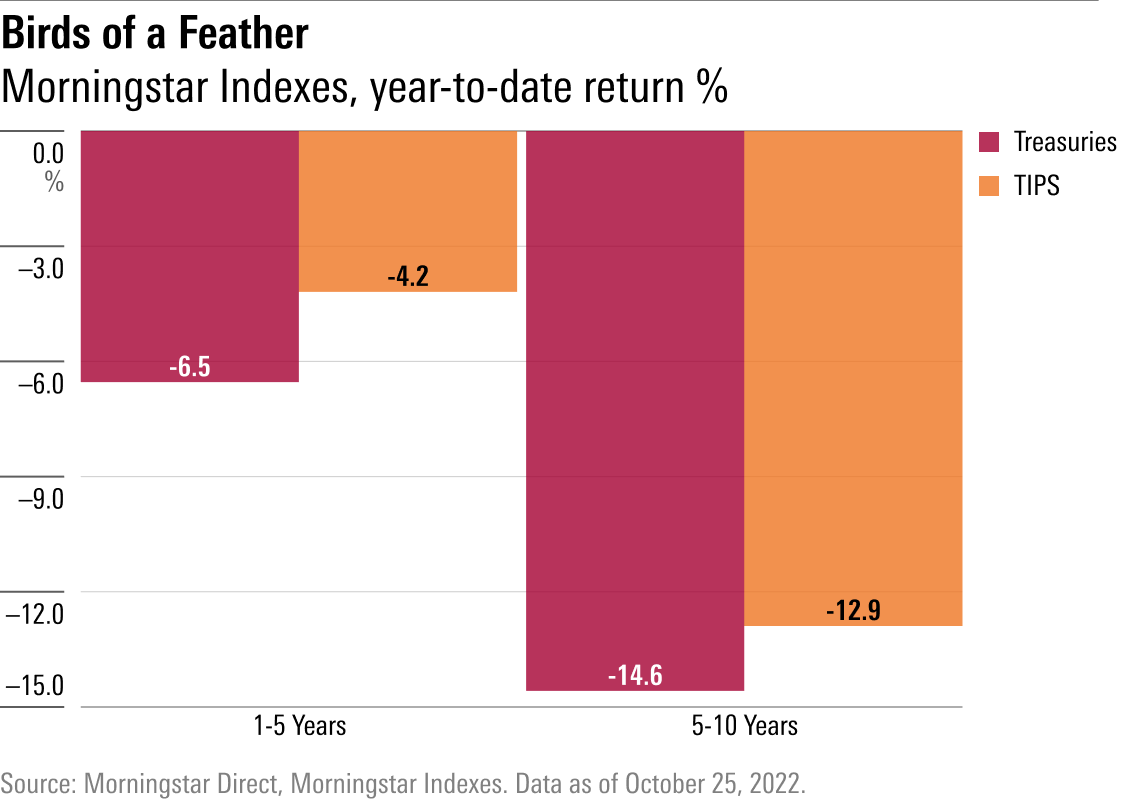

Is not difficult. TIPS have performed disastrously, barely outperforming traditional Treasuries that were designed to crush should inflation strike.

What happened?

The bond yield can be broken down into two components: 1) the rate of inflation and 2) what is left over, called the real yield. With a conventional bond, those two components are hidden, because the security’s price is based on a single statistic, its nominal yield. A bond paying 4% can expect future inflation of 3%, yielding a real return of 1%; Or you can forecast 2% inflation, with a 2% real return. Any combination that adds up to 4% will explain the price of that security.

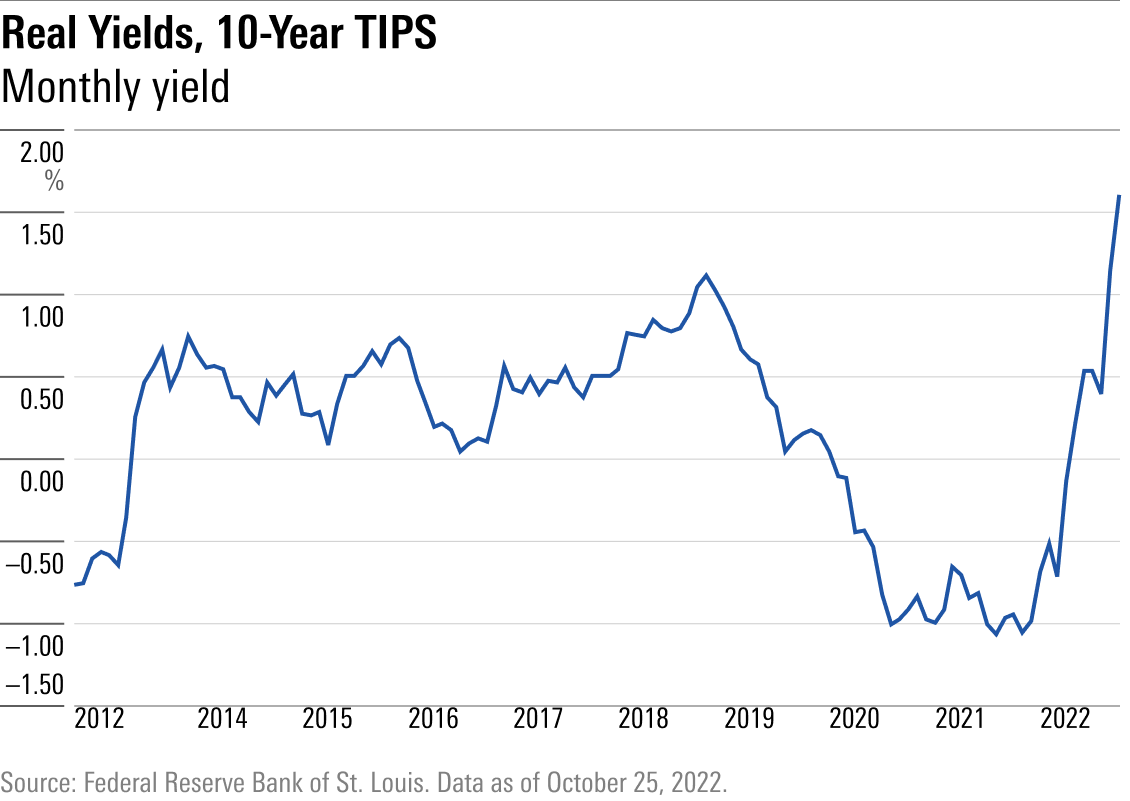

With TIPS, however, the numbers are explicit. Because all TIPS give the exact rate of inflation, TIPS prices can be used to calculate their real yields. The result reveals the popularity of TIPS, to what extent they are fashionable. A large real return means that investors refuse to own TIPS unless they receive a return that is much higher than the level of future inflation. Conversely, a negative real return indicates that buyers want TIPS so badly that they will give up their purchasing power to own them. They are, to use my colleague Paul Kaplan’s phrase, the “willing losers” of the market.

The latter, to be fair, is not strictly correct. If the real return on TIPS turns even more negative, investors who own those securities can resell them at a profit. Unless one holds TIPS until they mature, their eventual total returns are uncertain, because market decisions will affect the outcome.

Which is exactly what happened, but in reverse. From spring 2020 to December 2021, TIPS had been abnormally expensive, posting the deepest negative returns in their history. This year, that cousin collapsed. In nine months, TIPS went from being more expensive than ever in the last decade to being unquestionably cheaper. The chart below shows real 10-year TIPS yields over the past decade; the history of the five and 30 year versions is similar.

Caught

If it seems strange to you that securities designed to combat inflation implode when first faced with that very event, join the crowd. Although investment professionals were earlier aware of the fact that market movements could disrupt the inflation protection offered by TIPS, as with this New York Times article or Charles Schwab SCHW’s note, few (if is that there was any) expected this level of carnage. Quite the contrary. When CNBC talked to various pundits a year ago about “where to put your money during a spike in inflation,” the top consensus response was… TIPS.

The good investment news, of course, is that after suffering such huge losses (particularly with 30-year TIPS, which have lost a third of their value this year), TIPS may have become a bargain. Next Tuesday’s column will explore whether that is so or if TIPS need to get even cheaper to justify their purchase.

Appendix

Technically, as some writers have pointed out, TIPS respond to rising inflation expectations, as opposed to rising inflation itself or higher interest rates. I dodged that discussion for two reasons. First, it is beside the point, as even those who made that distinction did not expect TIPS to fail so spectacularly. Second, while true, that argument does not explain why TIPS failed. It requires believing that investors raised their inflation expectations last year and then lowered them in 2022. That seems highly unlikely.

In any case, figuring out why TIPS have performed so poorly is a topic for another longer article. Suffice it to say here that they have.

Correction

This article incorrectly noted that Treasury made the April 12 announcement; It was the Department of Labor.

Source: news.google.com