Dimitrios Kambouris/Getty Images Entertainment

Ulta Beauty (NASDAQ:ULTA) Second quarter results were nothing short of spectacular. In this article, I’ll look at the beauty retailer’s second quarter earnings and why I’m still a big Ulta sire.

Another great earnings report

Surprise, surprise: another Ulta Beauty earnings hit and another reason to own stock.

Ulta once again posted record numbers and increased its guidance in the quarter.

Second quarter non-GAAP EPS of $5.69 (vs. $4.52 Y/Y) is $0.70 higher. Revenues of $2.3B (+16.8% Y/Y) exceed $100M. Comparable sales increased 14.4%

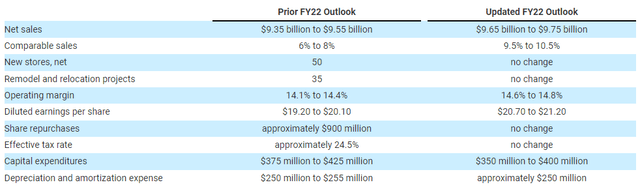

Ulta not only beat expectations, but again increased full-year revenue, EPS and CAPEX guidance for the second half of 2022.

Guide (Company Files)

Ulta is known for providing conservative guidance and then raising expectations as it gains more clarity towards the end of the fiscal year. However, management continues to meet and exceed expectations, effectively weathering headwinds.

As we continue to face each other uncertainties in the current macro environment, we are focused on delivering great guest experiences and driving sustained profitable growth. Longer term, we believe the beauty category will remain resilient and we are confident that we are a differentiated and proven growth model and strategycombined with our outstanding associates, they will continue to position Ulta Beauty as the beauty destination of choice.

Growth on all fronts

At a difficult time for corporate America, Ulta continues to show growth on all fronts. Once again, comparable sales increased 14.4% this quarter compared to the consensus of 10.3%. While the second quarter of 2021 saw like-for-like sales up 56.3%, the inflated figure was due to a temporary COVID spike.

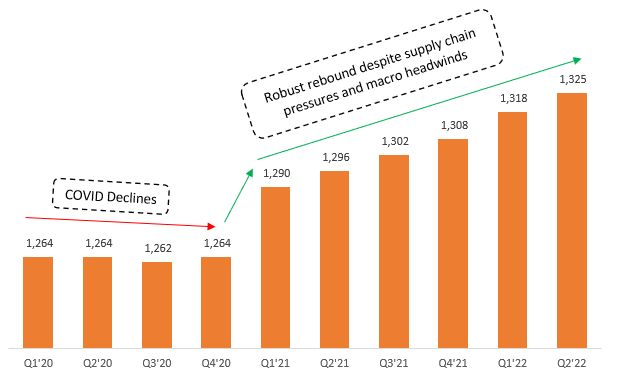

Like-for-like sales of 14.4% demonstrate Ulta’s strong business model and ability to generate sales from its existing stores. In addition, Ulta opened 7 net new stores in the second quarter, bringing the total store count to 1,325.

author created (Company Files)

With macro headwinds followed by COVID-19, this may be one of the most difficult environments any retailer has had to face in recent memory. Just a few days ago, the market saw leading discount retailer Nordstrom (JWN) tank after weaker-than-expected earnings and reduced store traffic.

The beauty of Ulta’s growth, however, is that the company doesn’t rely solely on one segment to deliver strong growth. Ulta delivered strong growth in all of its operating segments: cosmetics, hair care, skin care and fragrances.

At 43% of ULTA revenue, the cosmetics segment generated double-digit compensating growth in both the mass and prestige categories. The introduction of new brands and Ulta’s ability to generate sales from existing brands continue to be the backbone of Ulta’s sales.

CEO Dave Kimbell stated on the second quarter earnings call that:

Guests continue to engage with new brands like Fenty Beauty, REM Beauty and Halsey’s recently launched makeover, while new products from established brands like Clinique, NYX, elf and ColourPop also contributed to sales growth. Additionally, the ongoing expansion of MAC and CHANEL Beauty into more stores contributed to Prestige’s strong performance.

Within hair care, Ulta’s Gorgeous Hair Event shows its commitment to engaging its already loyal customer base.

our semester beautiful hair eventa strategic event designed to acquire new guests, increase spending by existing members and drive salon penetration.

Skin care was Ulta’s strongest revenue growth segment for 2 main reasons.

New educational brands Contents

novelty continued to attract guests with newer brands such as recently launched Drunk Elephant, Fresh, Supergoop and Vacation, as well as new products from PEACH & LILY, OSEA and Hero Cosmetics contributing to category growth during the quarter.

Additionally, Ulta does not rely solely on new and existing brands to retain customers, but also focuses on promotional events and beauty content to further engage customers.

Skinfatuation our monthly skin care programwhich works to demystify skincare with educational content and focused topics generated good growth for established brands like Tula, Sun Bum, Kola and Good Molecules.

Ulta’s store-in-store partnership with Target (TGT) is also a key lever for growth, with a long-term goal of 800 total Ulta locations at Target. In the second quarter, Ulta opened 59 Target stores, bringing the total to 186 locations.

customers will pay

As inflation continues to hit the economy with full force, customers are becoming more selective about what they spend their money on. As brands continue to raise their prices due to rising input costs, Ulta must do the same to maintain its margins.

we have received a large number of price increases from our brand partners in the first half of this year. Given the constant cost pressures facing our brand partners, expect to receive additional raises as we go through the rest of the year.

However, Ulta showed that its customers are still willing to buy despite modest price increases.

When CEO Dave Kimbell was asked about customer resiliency, his response focused on strong growth across all categories and revenue levels.

We’re not experiencing that or seeing that right now, similar to what we talked about last quarter. We’re seeing strong growth in all aspects of our business. As I mentioned, each category performed in the double digits, strength across all channels, stores, eCommerce services. And as we look at the income levels of our guests, we see healthy growth at all income levels. Therefore, there are no real downside trading signs or signals within the market yet.

As a company, Ulta is clearly confident of navigating inflationary headwinds. As I mentioned in my first Ulta article, cultivating a loyal customer base is a key component of the investment thesis for Ulta. Its best-in-class loyalty program retains customers and increases their willingness to pay a small premium.

Ulta’s second quarter proved that the beauty retailer would be able to navigate the macroeconomic headwinds that lay ahead.

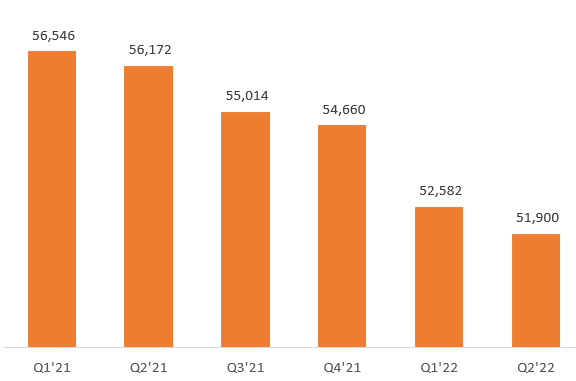

Committed to buybacks

Ulta’s business model is quite simple when it comes to generating cash. Allocate a chunk for CAPEX, retain a nice chunk of cash to keep on the balance sheet, and buy back shares with the rest. As shown below, Ulta has committed to reducing the outstanding share count as a form of capital allocation.

author created (Company Files)

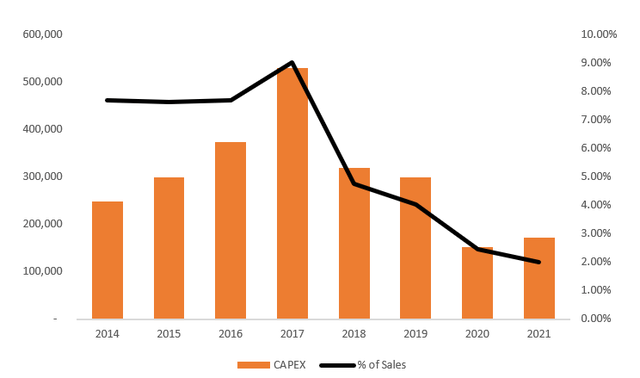

Additionally, Ulta is cautious with CAPEX as a percentage of revenue, from 8% in 2014 to just 2% in 2022.

author created (Company Files)

In F’21, Ulta had a cash balance of just over $430 million on its balance sheet with no long-term debt.

quite valued

Trading at 20x earnings, Ulta is not an overvalued stock. While trading its peers for lower multiples, Ulta’s industry leadership and growth rates justify the premium valuation. Looking at specialty retail leaders like Lululemon (LULU) trading at ~40x earnings, Ulta is pretty cheap on a relative basis.

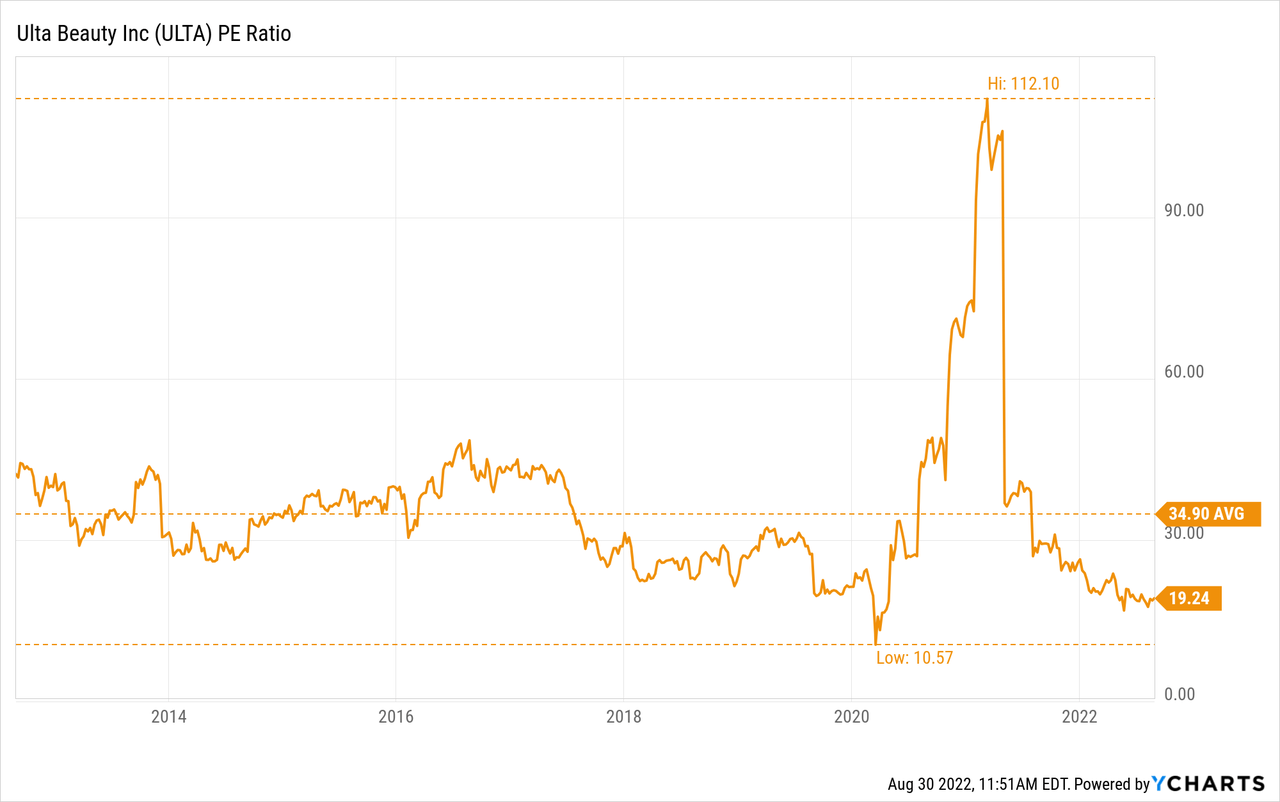

ULTA PE Relationship Data by YCharts

ULTA PE Relationship Data by YCharts

Trading below its pre-COVID average PE ratio, Ulta’s valuation is not a cause for concern. To the contrary, investors may even see the current multiple expand in the future if Ulta continues to pull the right growth levers.

the future looks bright

All in all, Ulta ended the quarter with another stellar earnings report. Exceeding expectations, increasing guidance, growing in all categories and buying back shares are exceptional signs for shareholders that indicate a bright future.

Additionally, Ulta hasn’t even started tapping into international markets yet, focusing entirely on dominating the US market through store growth, brand depth and customer loyalty, all of which will fuel Ulta’s future growth.

As long as it continues to focus on its expansion plans and exceed expectations, the future is bright for the retailer. Therefore, I reiterated my “Buy” recommendation for Ulta.

Source: seekingalpha.com