Generally speaking, the goal of active stock picking is to find companies that provide above-average returns for the market. And in our experience, buying the right stocks can give you a significant boost to your wealth. For example, him JD Sports Fashion plc (LON:JD.) stock price has risen 95% in the last 5 years, clearly outpacing the market decline of around 3.6% (ignoring dividends).

Let’s take a look at the underlying fundamentals over the long term and see if they have been consistent with shareholder returns.

Our analysis indicates that J.D. is potentially underrated!

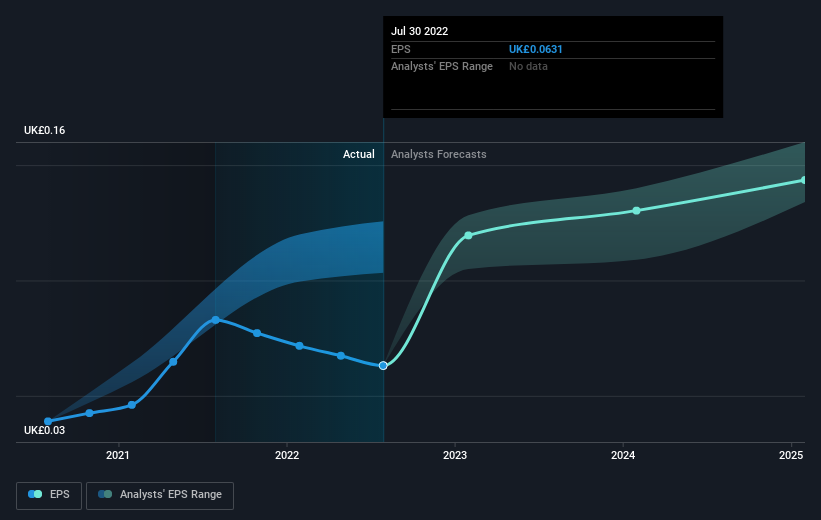

There’s no denying that markets are sometimes efficient, but prices don’t always reflect underlying business performance. A flawed but reasonable way to gauge how sentiment around a company has changed is to compare earnings per share (EPS) with the share price.

For half a decade, JD Sports Fashion managed to increase its earnings per share by 9.0% per year. This EPS growth is slower than stock price growth of 14% per year, over the same period. This suggests that market participants hold the company in higher esteem these days. That’s not necessarily surprising considering the five-year track record of earnings growth.

The graph below shows how EPS has changed over time (find out the exact values by clicking on the image).

We like that the experts have been buying stocks in the last twelve months. Even so, future earnings will be much more important in determining whether current shareholders make money. It might be worth taking a look at our free JD Sports Fashion earnings, revenue and cash flow report.

What about dividends?

In addition to measuring stock price performance, investors must also consider total shareholder return (TSR). The TSR incorporates the value of any discounted spin-offs or capital raises, together with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay generous dividends, the TSR is typically much higher than the stock price return. It just so happens that JD Sports Fashion’s TSR over the past 5 years was 97%, which exceeds the aforementioned stock price performance. And there’s no prize in guessing that dividend payouts largely explain the divergence!

a different perspective

We regret to report that JD Sports Fashion shareholders are down 40% on the year (including dividends). Unfortunately, that’s worse than the overall market drop of 1.7%. However, it could simply be that the share price has been affected by general market jitters. It may be worth keeping an eye on the fundamentals, in case there is a good opportunity. Longer-term investors wouldn’t be so upset, since they would have earned 14% each year for five years. If fundamental data continues to indicate sustainable growth over the long term, the current sell-off could be an opportunity worth considering. I find it very interesting to look at the stock price over the long term as an indicator of business performance. But to get a real picture, we must also consider other information. For example, we have discovered 2 Warning Signs for JD Sports Fashion that you should consider before investing here.

If you like buying shares along with management then you will love this free company list. (Hint: the experts have been buying them.)

Please note that the market returns quoted in this article reflect the market weighted average returns of shares currently trading on GB exchanges.

Valuation is complex, but we are helping to simplify it.

Find out if JD Sports Fashion is potentially overvalued or undervalued by checking out our comprehensive analysis, including fair value estimates, risks and warnings, dividends, internal transactions and financial health.

View the free analysis

Do you have comments on this article? Worried about the content? Get in touch with us directly. Alternatively, email the editorial team (at) Simplywallst.com.

This Simply Wall St article is general in nature. We provide feedback based on historical data and analyst forecasts using only unbiased methodology and our articles are not intended to be financial advice. It is not a recommendation to buy or sell any stock, and it does not take into account your goals or financial situation. Our goal is to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account the latest announcements from price-sensitive companies or qualitative material. Simply Wall St does not have a position in any of the mentioned stocks.

Source: news.google.com