Warren Buffett famously said, “Volatility is far from synonymous with risk.” So it seems that the smart money knows that debt, which is usually involved in bankruptcies, is a very important factor when evaluating how risky a company is. Like many other companies JD Sports Fashion plc (LON:JD.) makes use of debt. But the real question is whether this debt makes the company risky.

When is debt a problem?

Debt and other liabilities become risky for a company when it cannot easily meet those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, lenders can take over the business. However, a more common (but still costly) situation is when a company must dilute shareholders at a cheap share price simply to control debt. However, by replacing dilution, debt can be an extremely good tool for companies that need capital to invest in growth with high rates of return. The first step in considering a company’s debt levels is to consider its cash and debt together.

review the opportunities and risks within the UK specialty retail industry.

How much debt does JD Sports Fashion have?

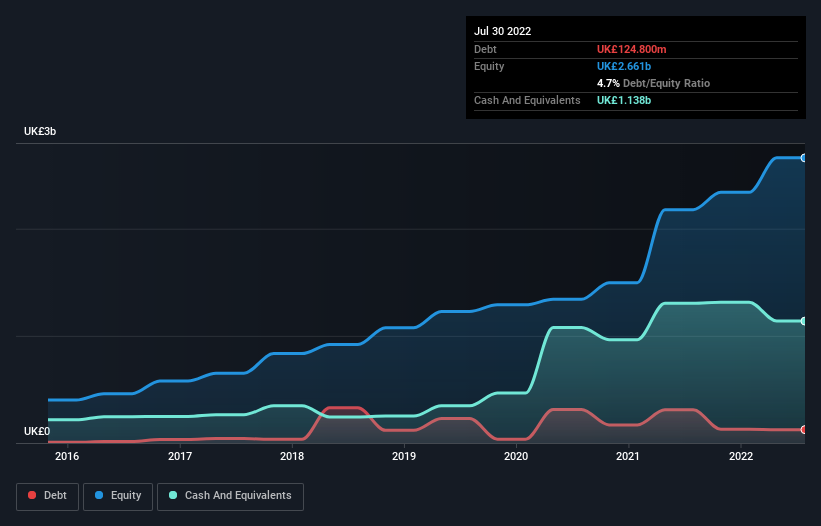

You can click on the chart below to see the historical numbers, but it shows that JD Sports Fashion was £124.8m in debt as of July 2022, up from £309.6m the previous year. However, his balance sheet shows that he has £1.14 billion in cash, so he actually has £1.01 billion in net cash.

How strong is JD Sports Fashion’s balance sheet?

The latest balance sheet data shows that JD Sports Fashion had liabilities of £2.04 billion due in one year, and liabilities of £3.01 billion due later. To offset this, it had £1.14 billion in cash and £314.7 million in receivables due within 12 months. Therefore, its liabilities exceed the sum of its cash and (short-term) receivables by £3.6 billion.

This is a mountain of leverage relative to its £4.6bn market cap. This suggests shareholders would be greatly diluted if the company needed to shore up its balance sheet quickly. Despite its notable liabilities, JD Sports Fashion has net cash, so it’s fair to say that it doesn’t have a large debt load.

And we’re also pleased to note that JD Sports Fashion increased its EBIT by 12% last year, which made its debt load easier to manage. There is no doubt that we learn more about debt from the balance sheet. But it is future profits, more than anything else, that will determine JD Sports Fashion’s ability to maintain a healthy bottom line in the future. So if you want to see what the pros think, you might find this free report on analyst earnings forecasts interesting.

Finally, a business needs free cash flow to pay down debt; accounting earnings are simply not enough. While JD Sports Fashion has net cash on its balance sheet, it’s still worth taking a look at its ability to convert earnings before interest and taxes (EBIT) to free cash flow, to help us understand how fast it’s building. (or eroding) that cash balance. Fortunately for shareholders, JD Sports Fashion produced more free cash flow than EBIT over the last three years. That kind of hard cash conversion excites us as much as it does the crowd when the beat drops at a Daft Punk concert.

summarizing

While JD Sports Fashion has more liabilities than liquid assets, it also has net cash of £1.01bn. The icing on the cake was that it converted 104% of that EBIT into free cash flow, generating £592m. So we have no problem with the use of JD Sports Fashion debt. When looking at debt levels, the balance sheet is the obvious place to start. But ultimately, all companies may contain risks that exist off the balance sheet. These risks can be difficult to detect. All companies have them, and we have seen 2 warning signs for JD Sports Fashion you should know about

When all is said and done, sometimes it’s easier to focus on businesses that don’t even need debt. Readers can access a list of growth stocks with zero net debt 100% freeright now.

Titration is complex, but we’re helping to simplify it.

Find out if JD Sports Fashion is potentially over- or undervalued by checking out our comprehensive analysis, including fair value estimates, risks and caveats, dividends, internal transactions and financial health.

See the free analysis

Do you have comments about this article? Concerned about the content? Get in touch with us directly. Alternatively, email the editorial team (at) Simplywallst.com.

This Simply Wall St article is of a general nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodology and our articles are not intended as financial advice. It is not a recommendation to buy or sell any stock, and it does not take into account your goals or financial situation. Our goal is to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account the latest announcements from price-sensitive companies or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Source: news.google.com