The rate of inflation rose to 7% during December 2021, highlighting the need for fixed income investors to gain exposure to short-duration Treasury Inflation-Protected Securities (TIPS).

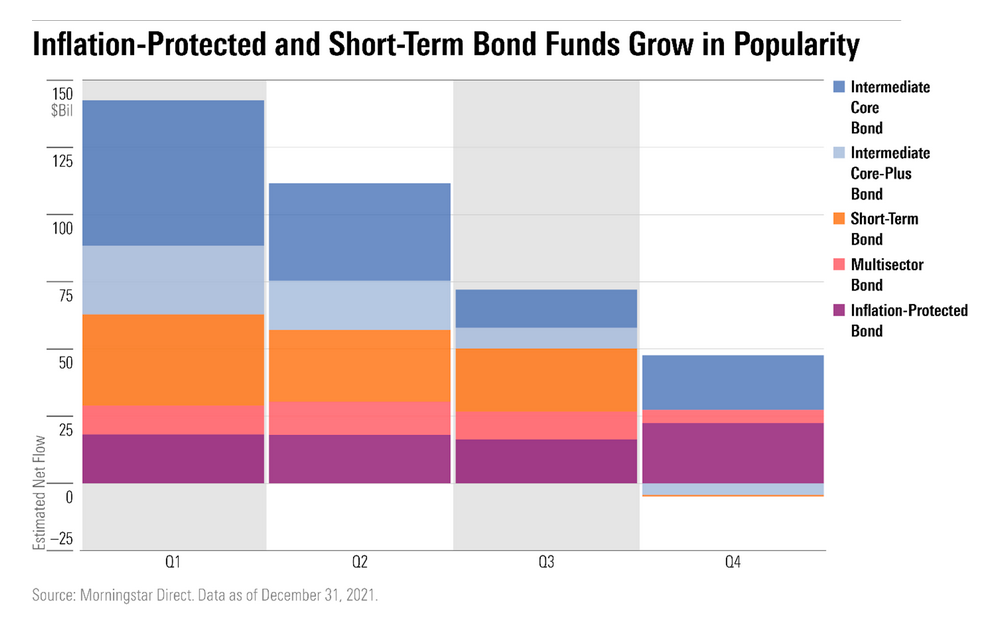

Investors are realizing this, and the flow of money into TIPS funds tells the story. 2020 was a strong year for TIPS entries followed by an even better year in 2021.

“Despite negative returns, money has been rushing into TIPS funds and ETFs lately,” reports the New York Times. “In 2020, net new flows of about $22 billion gushed forth, according to Morningstar. In the first 10 months of 2021 alone, those flows almost tripled, to $61 billion.”

“Yield may have been the draw: The average TIPS fund tracked by Morningstar returned 5.5 percent in 2021, compared with a 1.5 percent loss for the Bloomberg Barclays Aggregate Bond Index, an index of well-known bonds,” the report adds.

Reduced duration and protection against inflation

Gaining exposure to shorter duration date and inflation-protected bonds is available with a pair of FlexShares funds. Both ETFs have low expense ratios of 0.18%.

First of all, there is the FlexShares iBoxx 3-Year Target Duration TIPS Index Fund (TDTT). TDTT seeks to provide investment results that, before fees and expenses, generally correspond to the price performance and performance of the iBoxx 3-Year Target Duration TIPS Index, which reflects the performance of a selection of TIPS with a target average modified duration adjusted, as defined by the index provider, approximately three years.

“TDTT it can be useful as a tool to protect portfolios against anticipated increases in inflationary pressures,” explains an analysis of the ETF database. “TDTT it could be used, in moderate amounts, by buy-and-hold investors, or as a tactical play for those looking to switch to low-risk assets that can hold up well in inflationary environments.”

For investors looking to earn more yield while taking on higher rate risk, another option is the FlexShares iBoxx 5-Year Target Duration TIPS Index Fund (TDTF). The fund seeks to provide investment results that generally correspond to the price and return performance of the iBoxx 5-Year Target Duration TIPS Index.

“TDTF generally won’t deliver much in the way of current returns, as it features securities that are relatively close to maturity and exhibit minimal credit risk; it is more appropriate as a ‘risk-free’ tool for those who anticipate chaos in the markets”, says an analysis of the ETF database.

For more news, information, and strategy, visit the Multi-Asset Channel.

Source: www.etftrends.com