mo semsem

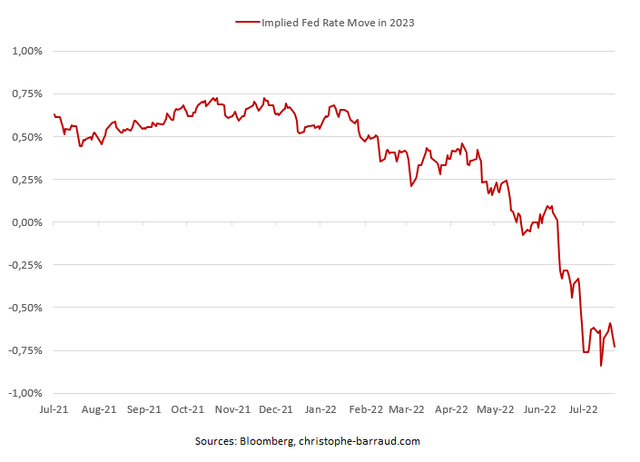

Ahead of a pivotal Fed meeting on Wednesday, bond traders appear to believe interest rate cuts are on the horizon shortly after this year’s tightening cycle. Currently, market prices in almost three rate cuts in 2023 after the the policy rate may peak in the 3.25% to 3.50% range later this year.

0.75% Rate Cuts Discounted in 2023

Christopher Barraud

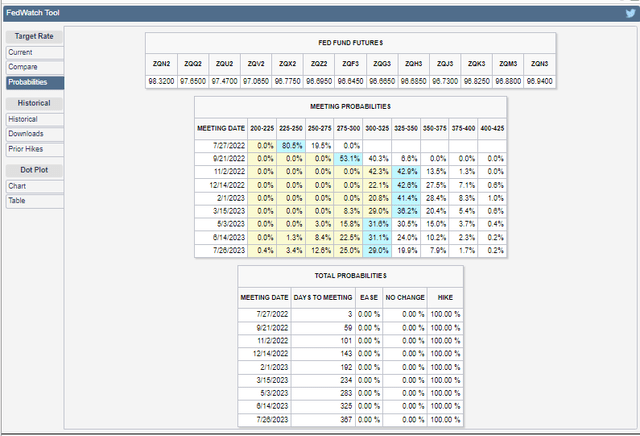

CME’s FedWatch odds chart shows interest rate hikes at each of the next three Fed meetings before a pause and possible easing cycle next year.

Traders See Fed Funds Peaking Near 3.5% in 2022

CME Group

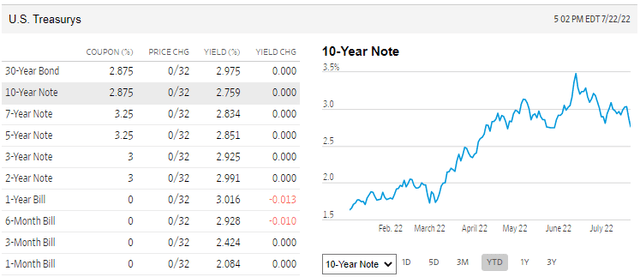

Treasuries have seen significant supply in the last six weeks. Since the last time the FOMC met, the yield on the US 10-year note has fallen from around 3.50% to around 2.75% last week, according to The Wall Street Journal.

Treasury yields fall sharply from June peak

WSJ

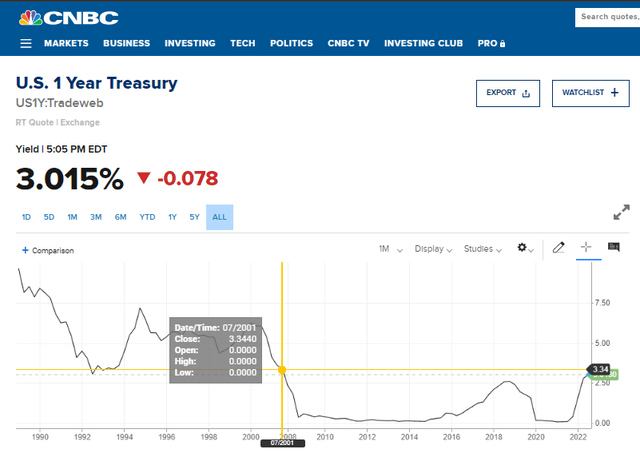

Right now, the yield curve is the most inverted since 2000, a clear sign that bond traders see recession risks rising. The good news for savers is that while inflation is still running at 9.1% (year over year through June), short-term Treasuries are yielding around 3.0%, the highest since 2001.

Savers rejoice: 1-year Treasury rate now tops 3%

CNBC

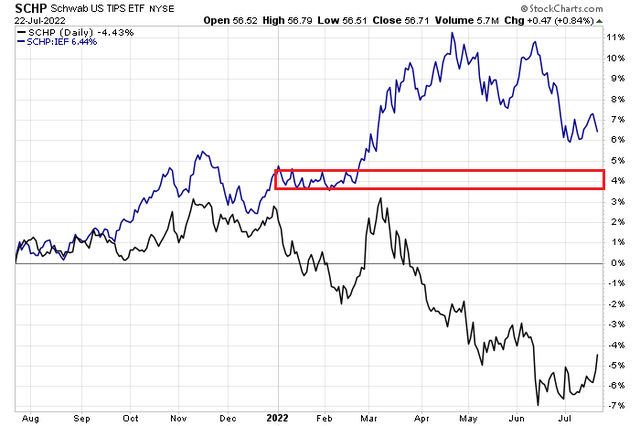

All of these monstrous moves in Treasury bills and notes come as fears of inflation subside. The five-year breakeven inflation rate, according to commercial markets, hit a new 10-month low last week at 2.56%, one percentage point lower than the high from earlier this year. “5y5y” forwards also pulled back from the year-to-date high of about 2.6%. A popular investment, along with Series I Savings Bonds, had been holding inflation-protected US Treasury securities through various ETFs. One ETF is among the most liquid and lowest-cost you’ll find: the Schwab US TIPS ETF (NYSERCA:SCHP), much less expensive than the popular iShares TIPS Bond ETF (TIP).

According to Schwab, SCHP’s goal is to track as closely as possible, before fees and expenses, the total return of an index composed of inflation-protected US Treasury securities. With an average maturity of 8.0 years, it is a broad indicator of the TIPS market. The ETF wrapper also provides some tax efficiency compared to a mutual fund. SCHP features an average bid/ask spread of just 0.02% and an expense ratio of just 0.04%. The weighted average yield to maturity is 2.42% as of March 31, 2022.

The technical take

The TIPS ETF far outperformed the iShares 7-10 Year Treasury Bond (IEF) ETF from the fourth quarter of 2021 to mid-April this year. However, since Tax Day, fears of inflation have subsided. Ergo, IEF has beaten SCHP. But is now the time to buy the dip (on a relative basis) in SCHP?

TIPS vs Treasuries: Looking at the consolidation of early 2020

Stockcharts.com

I say, “not yet.” I think SCHP could get back to where it was relative to IEF in mid-February (when Russia invaded Ukraine and when commodities started rising). Until then, the relative strength is on the side of simple Treasuries (IEF). Wednesday’s FOMC interest rate decision could change the narrative: I’d be a buyer of SCHP over IEF if we see a further pullback, targeting the 0% real rate of return.

10-Year TIPS Yield: Back to 0%?

TradingEconomy

The bottom line

All eyes are on Chairman Powell. This week’s Fed meeting should create more volatility in the Treasury market. Real yields have fallen to around 0.43%, according to Treasury.gov, after approaching 0.80% in early 2022. The chart suggests the rate could fall further to near break-even, at which point At this point it would make sense to have SCHP over IEF.

Source: seekingalpha.com