Khanchit Khirisutchalual

In my personal quest to find investments that would do well in today’s inflationary environment, I came across the ProShares Inflation Expectations ETF (NYSEARCA:RINF).

I think the RINF ETF is an excellent fund to own in the current environment where inflation is high and inflation expectations are rising. It mimics a pairs trade between a portfolio of TIPS bonds against a portfolio of treasury bonds of equivalent duration. This isolates exposure to rising inflation expectations.

Fund Overview

The ProShares Inflation Expectations ETF provides investment results that track inflation expectations. The RINF ETF has been around for a while (start date Jan 10, 2012), but has not caught on as inflation has not been an issue for the past decade.

Strategy

The RINF ETF seeks to achieve its investment objective by tracking the performance of the FTSE 30-Year TIPS (Treasury Rate-Hedged) Index. ProShares describes the Index as:

The index tracks the performance of (i) the long position in the most recently issued 30-year Treasury Inflation-Protected Securities (“TIPS”); (ii) duration-adjusted short position in US Treasuries of, in the aggregate, dollars in duration approximately equivalent to TIPS; and (iii) a cash equivalent value representing the repurchase rate earned on the short position. The Index is designed to measure the performance of the Equilibrium Rate of Inflation (BEI). The Index is not designed to measure the rate of realized inflation, nor does it seek to track the returns of any index or measure of actual consumer price levels. The index is built and maintained by FTSE International Limited. The index is published under the Bloomberg ticker symbol “CFIIRINF”.

Readers following my work will notice the similarity between the RINF Index ETF construction and a pair trading idea from my article on iShares TIPS Bond ETF (TIP). In the article, I described how one can still benefit from the inflation protection of TIPS bonds without the duration risk. Here is an excerpt from what I wrote:

A possible solution to the above problem is to keep the fund focused on TIPS such as the TIP ETF, covered with a short position in the iShares 7 – 10 Year Treasury Bond ETF (IEF) or some similar ETF.

What RINF ETF does is exactly my ‘pair trading’ strategy. ProShares will take care of duration hedging for a fee.

portfolio holdings

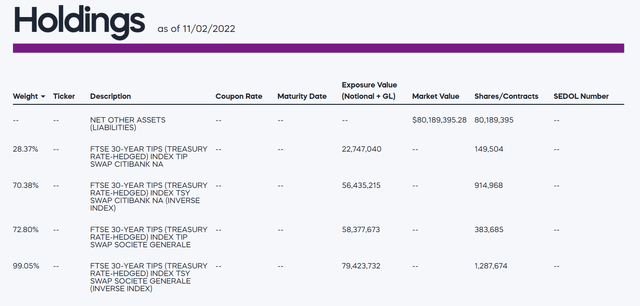

Rather than holding TIPS bonds and shorting Treasuries to hedge duration, the RINF ETF replicates this exposure by holding total return swaps against large investment banks such as Citibank (C) and Societe Generale (OTCPK:SCGLF) ( Figure 1).

Figure 1 – RINF ETF Holdings (proshares.com)

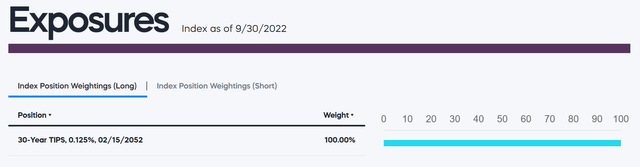

There are pros and cons to having synthetic exposures. The advantage is that the RINF ETF can have exact exposures without trading and constantly adjust its holdings. As we can see in Figure 2, the RINF ETF has a 100% long exposure to 30-year TIPS.

Figure 2 – Long exposure of RINF ETF (proshres.com)

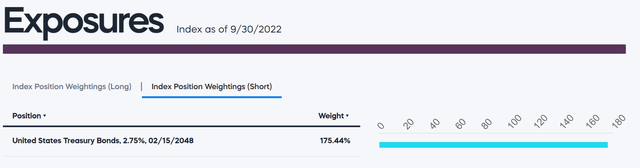

It also has a 175% short exposure to Treasuries due 2048. Presumably, this is to match the duration of the long TIPS position (Figure 3).

Figure 3 – RINF ETF short exposure (proshares.com)

On the downside, the RINF ETF introduces counterparty risk for the investment banks that sell the total return swaps to the fund. As the counterparties involved are Citibank and Societe Generale, both global systemically important banks (“Global SIBs”), this counterparty risk is low.

Returns

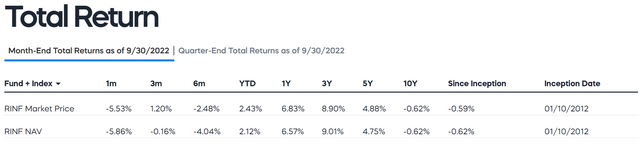

The RINF ETF has been a strong performer in the shorter terms, as inflation expectations have risen sharply in the past year. The RINF ETF has 1/3/5/10 year average annual returns of 6.8%/8.9%/4.9%/-0.6% through September 30, 2022 (Figure 4).

Figure 4 – RINF ETF Returns (proshares.com)

Distribution and Performance

The RINF ETF does not pay a current distribution.

One of the disadvantages of the RINF ETF compared to pair trading (Long TIP/Short IEF) is that the RINF ETF has synthetic exposures. This means that you don’t actually own the underlying bonds, so you don’t earn any income. On the other hand, the TIP ETF pays a trailing return of 7.56%, while the IEF ETF pays a trailing return of 1.79%, so pair trading gets a ‘positive’ carry. This may be important to some investors who want a current return on their investments.

Rate

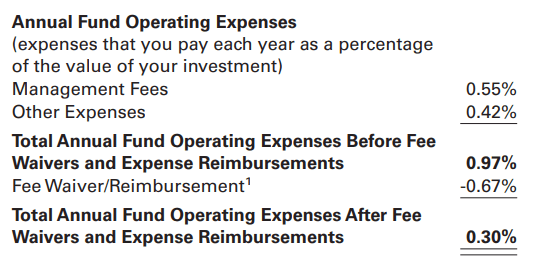

The RINF ETF usually charges a 0.97% fee. But with the fee waivers through September 30, 2023, the fee has dropped to 0.30%.

Figure 5 – RINF ETF Fees (RINF ETF Brochure)

When to own RINF?

As mentioned above, the RINF has performed strongly in recent years, but its longer-term performance has been poor, with a 10-year average annual return of -0.6%. What is happening and when should investors own RINF?

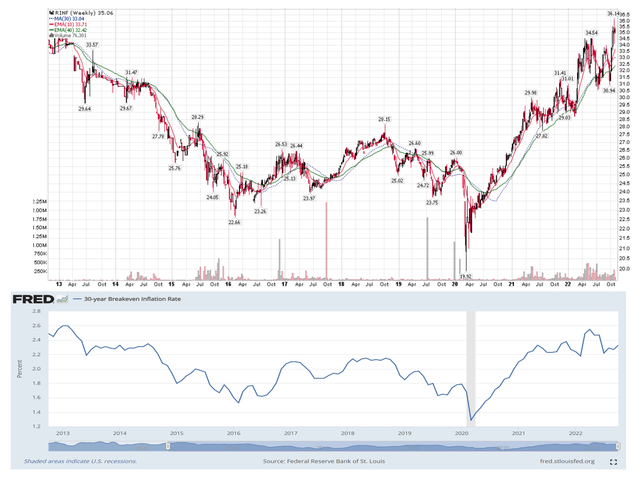

The simple answer is that investors should own the RINF ETF when inflation expectations are rising. Figure 6 below shows the RINF ETF superimposed on the 30-year inflation expectation rate. By design, the RINF ETF aims to track long-term inflation expectations, such as the 30-year inflation expectation rate (or more commonly called the “breakeven rate”).

Figure 6 – RINF versus 30-year break-even points (Created by author using price chart from stockcharts.com and break-even data from St. Louis Fed)

The longer answer is that over the last few decades, the world has experienced subdued inflation overall, so long-term inflation expectations were well anchored around 2% and falling, causing a steady decline in inflation. RINF value. However, the COVID-19 pandemic was a major deflationary shock, causing 30-year breakeven points to plummet to 1.29% and the RINF to fall below $20 per share. Subsequent massive government stimulus combined with COVID-induced supply constraints boosted inflation expectations with 30-year breakeven currently at 2.33%. This has caused an 80% rally in RINF from the COVID lows.

Short-term inflation measures have skyrocketed in the past year, well above the central banks’ 2% inflation target. For example, the most recent US Consumer Price Index (“CPI”) for September was 8.2% year-over-year and the Fed’s preferred measure of inflation, the PCE price index, increased by 5. 1% YoY.

Looking ahead, there are significant risks that high inflation will “take hold” in the minds of consumers. Every monthly inflation reading with a handle of 6, 7, 8% ‘normalizes’ the high rate of inflation and leads to a spiral of wage and price inflation. We are already seeing signs of unrest over wages, with US Railroad workers threatening a strike to demand higher wages. Similarly, Delta airline pilots are threatening strike action. In the latest ADP jobs report, workers who stayed in their current job saw wage gains of 7.7%, while those who changed jobs saw wage growth of 15.7%. The longer this episode of high inflation continues, the higher the inflation break-even points will be.

conclusion

In summary, the ProShares Inflation Expectations ETF is an excellent fund to own in today’s environment where inflation is high and inflation expectations rise as you risk consolidation. However, if the Fed manages to control inflation in the coming quarters, investors should avoid the RINF ETF.

Source: news.google.com